Logistics is a critical component of running a successful business: important decisions need to be made on the fly, and timely and efficient delivery of products is essential to meeting customer expectations and maintaining a competitive edge in the market. Coordinating the movement of products and materials from suppliers to manufacturers to distributors and ultimately to customers is no mean feat, and so, doing it right can have a significant impact on a company’s bottom line.

Unit economics can help simplify this process, by helping companies evaluate profitability of individual deliveries or routes, helping them to cull out the inefficiencies in operations and make necessary changes to improve profitability.

A regular evaluation of unit economics for a business helps to answer a very important question: Is the cost of acquiring your customer greater than the profit you make off them?

Calculating unit economics can help businesses in decision-making, benchmarking performance over time, comparing it with industry benchmarks and consequently informing long-term strategic planning. These factors help us determine the impact of the final unit economics of a business and throw light on the constraints on the types of fulfillment models a business can power.

In the last-mile, calculating the unit economics of cost of delivery helps to determine the profitability of each delivery transaction, allows businesses to make informed decisions about the pricing of delivery products and determine the most cost effective way to carry out deliveries. It’s also a great way to evaluate the viability of new business models such as delivery drones and autonomous vehicles in last-mile delivery. For example, if a business finds that it is consistently spending more on fuel than expected, it may want to consider using a more fuel-efficient mode of transportation or finding ways to reduce the distance traveled for each delivery.

By understanding the unit economics of last-mile operations, businesses can make informed decisions about pricing, routing and other logistics decisions that can affect the bottom line. It is also a great way to evaluate the viability of new business models such as delivery drones and autonomous vehicles in last-mile delivery.

According to this study, the global e-commerce sales is expected to grow by 56% over the next few years, reaching about 8.1 trillion dollars by 2026. It only makes sense then, that more retailers and logistics providers are vying for a share in the last-mile market. The result is price wars and margin compression, making maintaining profitability a challenge in itself.

The other conundrum is this: while customers are always seeking deliveries that are free and fast, last-mile delivery is also the most expensive and time-consuming part of the supply chain. The challenges take different forms with time. For example, as same-day or even same-hour delivery gains popularity, the costs associated with these services can be high.

Not only are last-mile processes difficult to plan, the volume of deliveries fluctuate according to the seasons, making it difficult for delivery companies to keep up and they often take help from external service providers.

Planning the ideal standardized delivery route is difficult as it is impossible to take all the variables into account: traffic congestion, limited parking space, unclear addresses, among others. And so, there is always an element of unpredictability that remains a part of the last-mile operation.

These challenges also present opportunities for companies to improve their unit economics, however. Businesses need to actively look for ways to streamline their production processes, which means reducing production costs by automating certain tasks, implementing lean manufacturing principles to optimize operations, look for ways to increase demand for your products, and consider entering into new markets to diversify your revenue streams.

The next step would be to evaluate the financial performance of a business at the unit level. This can be done by calculating the key metrics for unit economics. This way we get an insight into the revenue, cost and profitability of the business, all of which are crucial in order to mark out the potential areas of improvement, tracking progress over time and making data-driven decisions. Some of these are listed below:

This is the total cost incurred by a business to attract, convert, and onboard a new customer. It is calculated by dividing the sum of all sales and marketing expenses by the number of newly acquired customers. Understanding CAC is crucial in evaluating the efficiency and profitability of a company's customer acquisition strategy. A lower CAC indicates that the company is able to effectively attract customers at a cost-effective rate, which can drive long-term profitability.

This metric measures the estimated net profit that a business will earn from a customer over the entire duration of their relationship. It is calculated by multiplying the average revenue per customer by the average customer lifespan. LTV provides insight into a company's ability to retain and monetize customers in the long term, thus making it an important metric in evaluating overall business profitability. A higher LTV suggests that the company is effectively retaining and profiting from its customers over time.

This metric represents the ratio of a company's operating expenses to its revenue. It is calculated by dividing operating expenses by revenue. OER is a useful metric for identifying areas in a business that can be optimized to improve profitability. A lower OER indicates that the company is effectively managing its operating expenses, contributing to overall profitability.

Fulfillment costs are a key component of a business' unit economics. These costs include various expenses associated with delivering products to customers, such as order processing, fuel, driver and storage costs, restocking fees, return shipping fees, and customer service labor and picking and packing expenses.

For a business to keep its fulfillment costs under control its delivery infrastructure needs to be strong. Delivery trucks, depots, warehouses, all incur huge expenses, which only increase as businesses expand their last-mile operations.

Technology costs are another big expense—GPS tracking, route optimization software, delivery confirmation systems—all help to streamline processes but aren’t cheap. Some of these are listed below:

Implementing and maintaining delivery tracking and management technology are crucial for ensuring timely and accurate package deliveries. However, this technology incurs high costs, including hardware, software development, and ongoing maintenance and support expenses.

Automation and robotics technology can help to streamline the picking and packing process, but it also requires significant investment. This can include the cost of purchasing and installing the necessary equipment, as well as the cost of training employees to use it.

Data analytics and optimization tools are essential for analyzing delivery performance and identifying opportunities for improvement. However, these tools can be expensive to implement and maintain, requiring specialized software and expertise.

Mobile devices and communication technology enable real-time communication between delivery drivers and dispatchers. However, purchasing and maintaining these devices can be expensive, especially when considering the need for data plans and other ongoing expenses.

Cybersecurity has become a growing concern as last-mile delivery becomes increasingly digitized. Protecting against cyber threats can be expensive, including the cost of implementing and maintaining secure systems and training employees on cybersecurity best practices.

Implementing and maintaining delivery tracking and management technology are crucial for ensuring timely and accurate package deliveries. However, this technology incurs high costs, including hardware, software development, and ongoing maintenance and support expenses.

Automation and robotics technology can help to streamline the picking and packing process, but it also requires significant investment. This can include the cost of purchasing and installing the necessary equipment, as well as the cost of training employees to use it.

Data analytics and optimization tools are essential for analyzing delivery performance and identifying opportunities for improvement. However, these tools can be expensive to implement and maintain, requiring specialized software and expertise.

Mobile devices and communication technology enable real-time communication between delivery drivers and dispatchers. However, purchasing and maintaining these devices can be expensive, especially when considering the need for data plans and other ongoing expenses.

Cybersecurity has become a growing concern as last-mile delivery becomes increasingly digitized. Protecting against cyber threats can be expensive, including the cost of implementing and maintaining secure systems and training employees on cybersecurity best practices.

Since unit economics is the measure of profitability of each unit of product or service sold, understanding the cost structure of the company becomes important. There are various cost components that influence unit economics in the final leg of the supply chain. The most important of these include transportation, storage, and labor, and are crucial for determining the cost of acquiring and servicing customers.

The cost of order fulfillment rises as transportation costs do. This is affected by the price of fuel, the upkeep of the vehicle, and the pay of the driver, and these costs might change based on where the delivery is being made and the type of vehicle being utilized. The pricing strategy of a business is also impacted by these expenditures, reducing the company’s overall profitability.

Warehouse rent, utility costs, and labor costs are all associated with storage costs and can have a direct impact on the unit economics of cost of delivery. The longer a product is stored, the higher the storage costs will be, which can increase the cost of acquiring a customer. And the higher the costs, the more likely the company is to change a higher price for its products to cover these costs and maintain a positive unit economics.

A vital aspect of the last-mile, labor affects the cost of delivering and servicing a customer. It includes expenses such as wages, benefits, and training for employees involved in the delivery process. Companies can try to optimize their labor costs by streamlining delivery processes, reducing the time required for delivery, or utilizing alternative delivery methods.

The cost of order fulfillment rises as transportation costs do. This is affected by the price of fuel, the upkeep of the vehicle, and the pay of the driver, and these costs might change based on where the delivery is being made and the type of vehicle being utilized. The pricing strategy of a business is also impacted by these expenditures, reducing the company’s overall profitability.

Warehouse rent, utility costs, and labor costs are all associated with storage costs and can have a direct impact on the unit economics of cost of delivery. The longer a product is stored, the higher the storage costs will be, which can increase the cost of acquiring a customer. And the higher the costs, the more likely the company is to change a higher price for its products to cover these costs and maintain a positive unit economics.

A vital aspect of the last-mile, labor affects the cost of delivering and servicing a customer. It includes expenses such as wages, benefits, and training for employees involved in the delivery process. Companies can try to optimize their labor costs by streamlining delivery processes, reducing the time required for delivery, or utilizing alternative delivery methods.

Having efficient last-mile operations in place is crucial for businesses as poor logistics can lead to inflated costs in multiple areas. These inflated costs can result from issues such as poor supply-chain management, poor space utilization, increased delivery times, and higher fuel costs. If these costs are not managed effectively, the result could be higher and unsustainable pricing for the end customer. However, A Dispatch Management Platform (DMP) can help meet these challenges and provide the best possible customer experience:

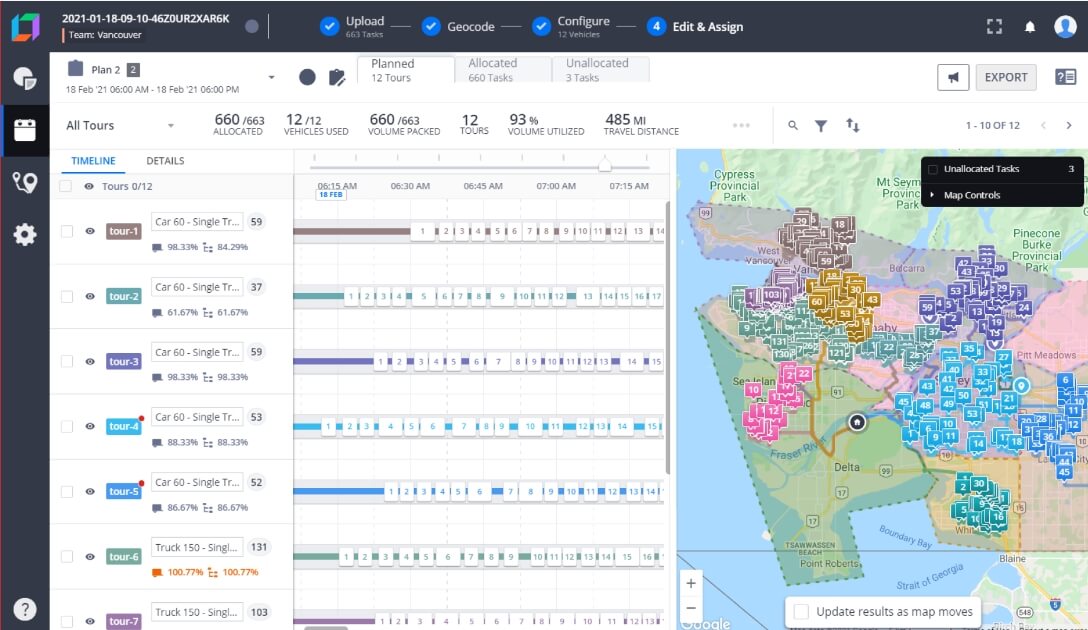

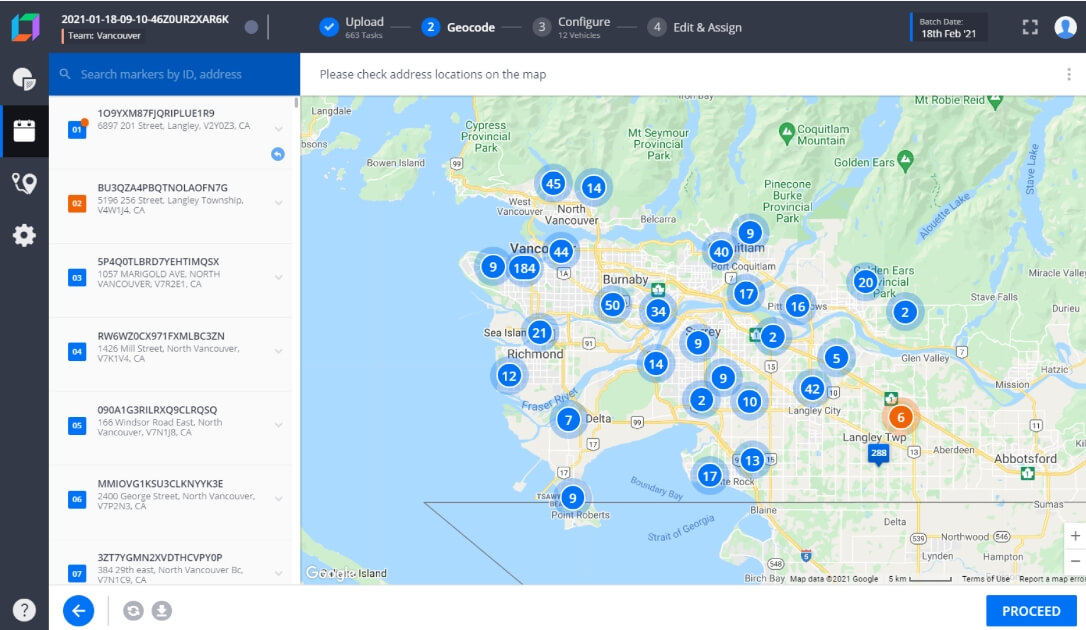

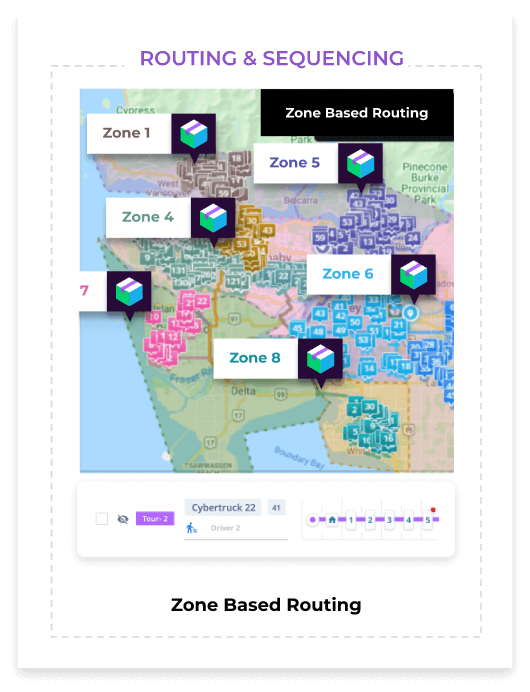

Optimizing routing and circumventing traffic congestion can help lower fuel consumption even further. Inefficient routing can also result in increased labor costs, which can be reduced by implementing more efficient routing solutions. Optimized routing can also help companies develop a competitive advantage by allowing them to offer lower delivery charges to customers while maintaining delivery efficiency, leading to positive customer feedback and repeat business. Using Locus’ DMP, businesses get to fulfill more orders and scale with fewer vehicles, save costs and boost productivity. Its dynamic and zone-based routing can allocate resources to zones and minimize overlap between service areas. Its powerful automation can plan and dispatch over 5,000 orders daily with minimal human intervention.

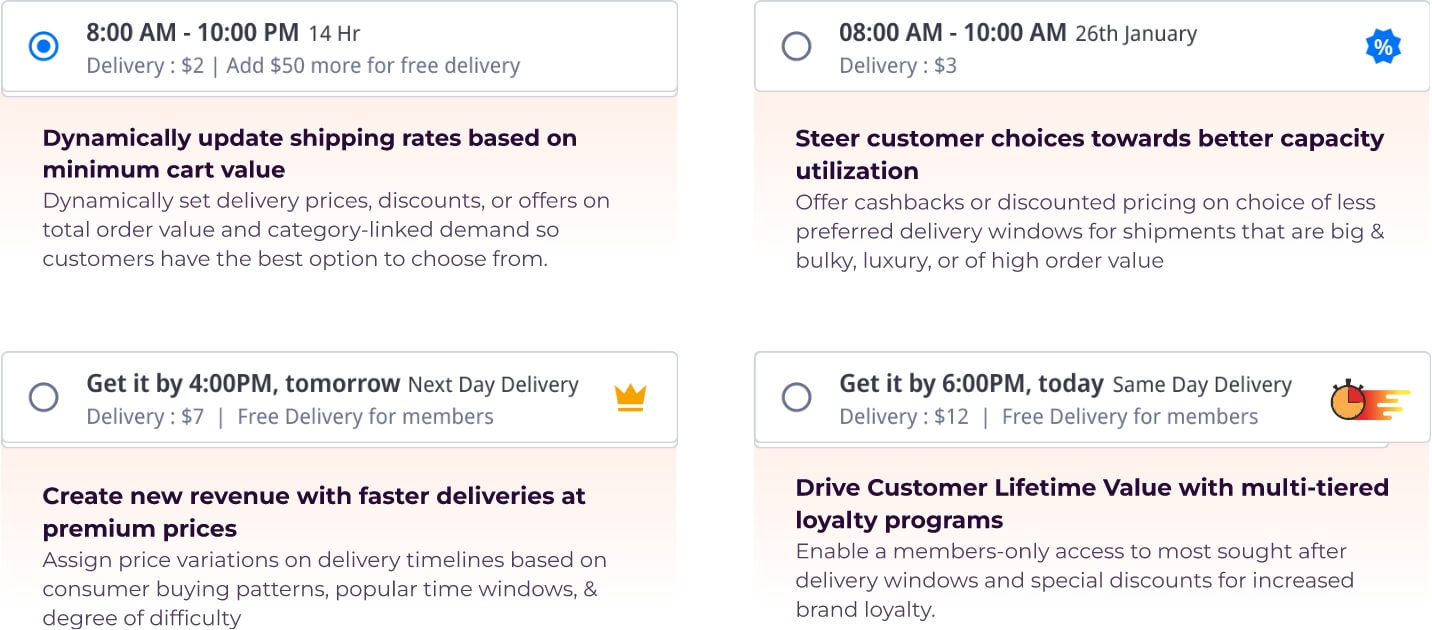

Assigning specific time slots for deliveries is a great way for businesses to optimize routes and reduce the likelihood of delayed or missed deliveries. Locus’ Delivery Linked Checkout (DLC) feature helps by doing just this—pushing slots at checkout on the basis of available capacity, logistics costs and business constraints. Higher drop density and better resource utilization mean increased efficiency, fewer vehicles and less time on the road. Higher first attempt delivery rates and on-time deliveries also help you align operational excellence with customer experience.

Orders placed in advance allow businesses to pre-plan inventory, storage and delivery capacity for maximized fleet utilization and OTIF deliveries. Intelligent order grouping and driver-vehicle allocation for minimized transit distance and high resource utilization.

The DMP helps to map addresses precisely and eliminate inefficiencies, saving time and cost. It deciphers even the fuzziest of addresses to convert them into accurate geo-coordinates for seamless routing. Locus’ geocoding engine alerts dispatchers in case of poor address accuracy, helps wade throught traffic, reduce transaction times, as well as accounts for any kinds of resequences. The platform’s strategic routing unlocks zone-level SLA and resource management to maximize driver efficiency.

Another one of the benefits of DLC is that by improving the overall quality of delivery service, it can help improve turnover rates. Delivery personnel benefit from a structure in their schedule, feel empowered, more interested in their work and are less likely to experience burnout. The result is higher productivity and retention rates.

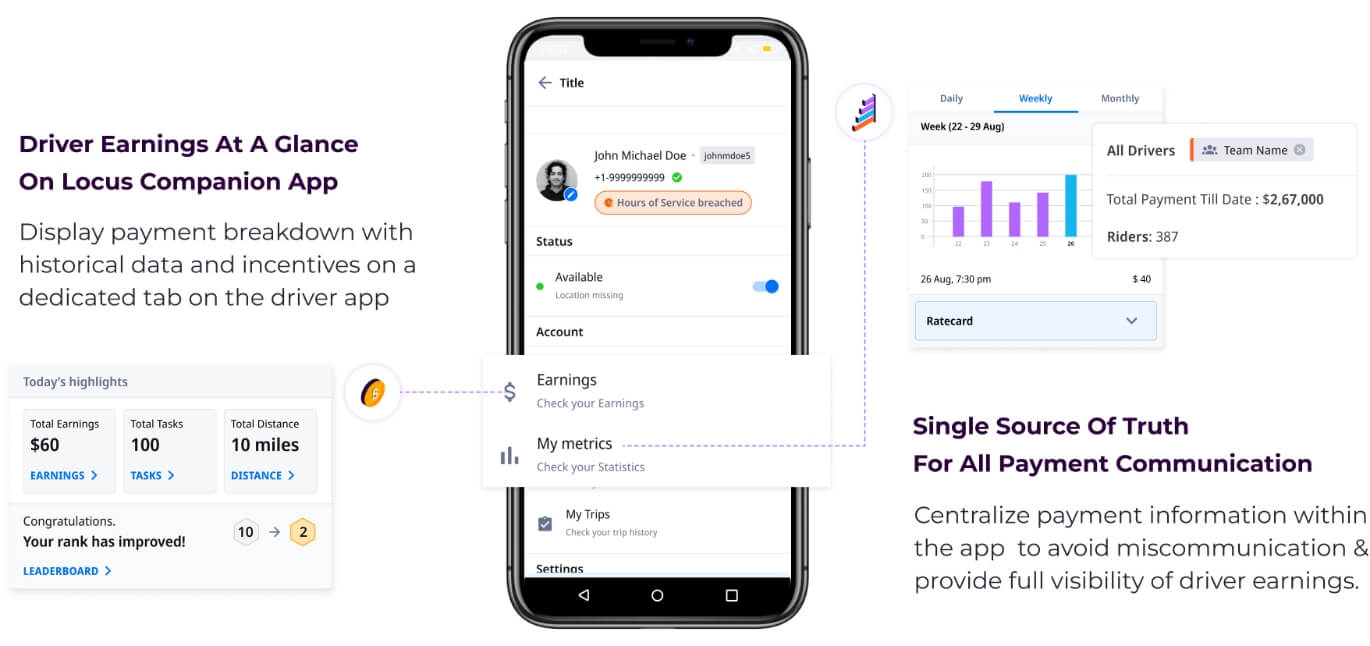

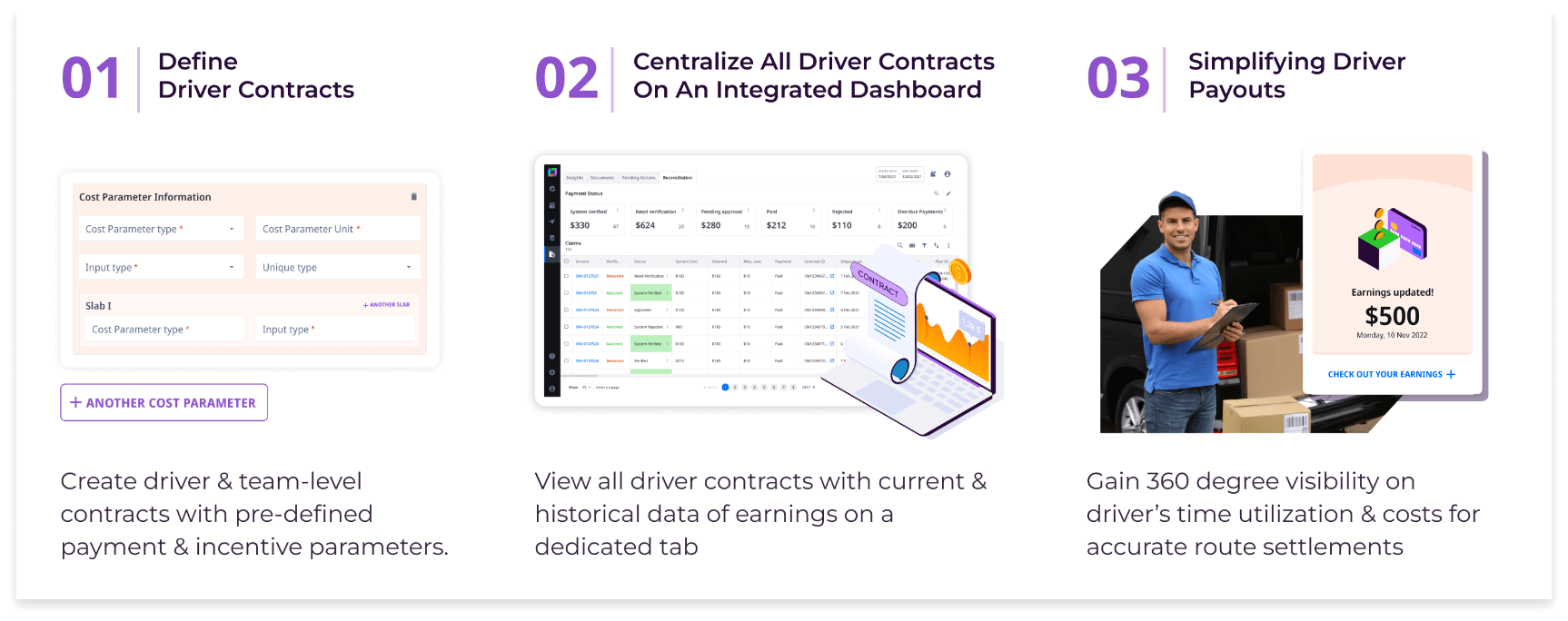

Single channel visibility on the Driver Companion App helps in avoiding any discrepancies and errors in payment, allowing businesses to build good relationships with their drivers. Built-in price guides also standardize earning potential for drivers, ensuring consistency in their earnings and helping them stay motivated by providing insights on how they can earn more.

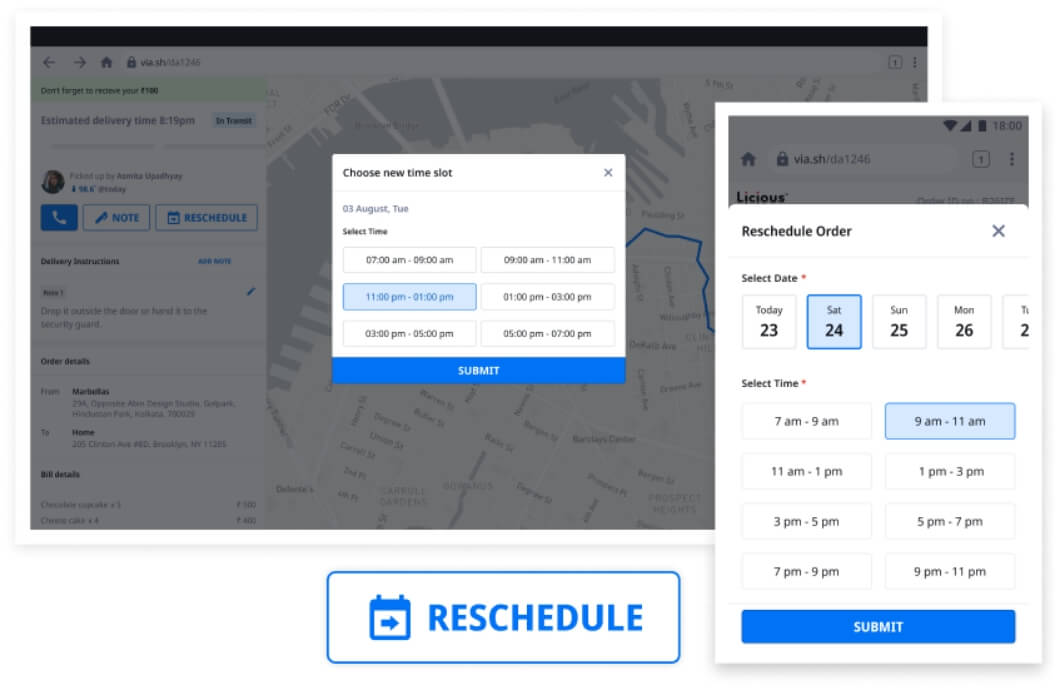

Multiple delivery windows—ten minutes, two hours, same day, next day—help you capture a wide range of customers by meeting their daily requirements. Priority-based deliveries that fit into customers’ schedules and availability incentivize them to pay a premium surcharge and encourage brand loyalty. They can also help to differentiate a business from competitors by providing a unique selling point and enhancing customer satisfaction.

By identifying and leveraging various revenue streams, businesses can diversify their sources of income, and reduce the risk associated with relying on a single stream. Not only does this help increase the overall revenue and mitigate the impact of any fluctuations in a single revenue stream, it also allows the company to take advantage of different pricing models and revenue opportunities. These are some of the main revenue drivers in the last-mile supply chain:

The most common and obvious revenue stream in the last-mile supply chain is the sale of goods and services to customers. This includes the sale of products, such as groceries, electronics, or clothing, as well as services, such as delivery or installation services. The sales of goods and services are directly related to unit economics, as the cost of acquiring a customer and delivering the product must be lower than the revenue generated by the sale.

Another way to increase revenue in the last-mile supply chain is through upselling and cross-selling. This involves offering customers additional products or services, such as warranties, insurance, or accessories, that complement the product they have already purchased. Upselling and cross-selling can improve unit economics by increasing the revenue generated from each customer, which can offset the cost of acquiring and delivering the product.

A third revenue stream in the last-mile supply chain is subscriptions and memberships. This involves offering customers the ability to subscribe to a service, such as monthly deliveries of groceries, or membership in a loyalty program, which provides exclusive discounts and offers. Subscriptions and memberships can improve unit economics by generating recurring revenue and increasing customer loyalty, which can reduce the cost of acquiring new customers.

Finally, companies can also generate revenue by collecting and analyzing data related to the last-mile supply chain. This data can be used to improve delivery processes, identify trends and patterns, and target advertising to specific customer segments. The sale of this data and analysis can generate significant revenue and improve unit economics by reducing the cost of acquiring and servicing customers, as well as increasing the effectiveness of marketing efforts.

Allowing customers to choose alternate date and time for shipment delivery even after order dispatch and creating precise delivery schedules allows you to meet customers where they are. Friction free cancellations via tracking page help keep the positive customer experience alive. The Locus insights dashboard helps track several KPIs as well, and generates reports for you to make well-informed strategic decisions.

Evaluating unit economics in last-mile delivery can help businesses to identify inefficiencies in their operations, make necessary changes, and inform long-term strategic planning. Calculating the unit economics of last-mile operations can enable businesses to make informed decisions about pricing, routing, and logistics, and to evaluate the viability of new business models in last-mile delivery. The challenges associated with last-mile delivery also present opportunities for companies to improve their unit economics, by streamlining production processes, reducing costs, increasing demand for products, and diversifying revenue streams. By continually evaluating and optimizing unit economics, companies can deliver value in the last-mile, meet customer expectations, and maintain their profitability in an increasingly competitive market.

The 3PL/CEP industries are heavily dependent on transportation, as their main service involves moving goods from one place to another. These businesses must manage costs associated with vehicle acquisition and maintenance, fuel, and tolls, among others. Further, efficient route optimization is crucial to reduce these costs and achieve faster delivery times, thereby enhancing customer satisfaction.

Storage costs in these sectors pertain to warehousing expenses, including rent, utilities, security, and equipment like forklifts. Efficient inventory management is critical in reducing storage costs, since holding inventory for longer periods can increase costs.

The labor costs in these sectors often revolve around the hiring of drivers, warehouse workers, and logistics personnel. Automation and the use of advanced technologies like AI can help reduce these costs, but also require significant initial investment.

The 3PL/CEP industries are heavily dependent on transportation, as their main service involves moving goods from one place to another. These businesses must manage costs associated with vehicle acquisition and maintenance, fuel, and tolls, among others. Further, efficient route optimization is crucial to reduce these costs and achieve faster delivery times, thereby enhancing customer satisfaction.

Storage costs in these sectors pertain to warehousing expenses, including rent, utilities, security, and equipment like forklifts. Efficient inventory management is critical in reducing storage costs, since holding inventory for longer periods can increase costs.

The labor costs in these sectors often revolve around the hiring of drivers, warehouse workers, and logistics personnel. Automation and the use of advanced technologies like AI can help reduce these costs, but also require significant initial investment.

By closely examining the financial dynamics of the 3PL/CEP industry, we identify the key factors that affect its operations and economic performance. By understanding these factors, industry players can make informed decisions to drive growth and success in this competitive sector.

3PL and CEP services often have contracts and negotiated rates with carriers or shipping providers. These rates can vary based on factors such as shipment volume, weight, distance, and service level. When calculating unit economics, it's crucial to account for these negotiated rates and understand how they impact the overall delivery costs.

Many 3PL and CEP services utilize zone-based pricing structures, where the delivery cost is determined based on the distance or geographic zone. Different zones may have varying delivery costs, which need to be considered when calculating unit economics. The distance traveled and associated costs for each zone can impact the profitability of individual deliveries.

3PL and CEP providers often offer different service levels, such as standard delivery, express delivery, or same-day delivery. Each service level may have its associated costs and customer expectations. It's important to consider these service-level differentiations and their corresponding costs when calculating unit economics.

Shipment density plays a significant role in the economics of 3PL and CEP services. Consolidating multiple shipments into a single delivery can help optimize costs by maximizing the capacity of each delivery vehicle and reducing fuel and labor expenses. Analyzing shipment density and the potential for consolidation is essential in accurately calculating unit economics.

3PL and CEP services often provide additional value-added services, such as warehousing, inventory management, order fulfillment, or returns processing. These services may generate additional revenue streams but also incur costs. When calculating unit economics, it's important to consider the profitability of both the core delivery service and any supplementary services offered.

Like in retail, 3PL and CEP services may experience seasonal fluctuations in demand. These periods require careful capacity planning to ensure adequate resources are available to handle peak volumes. Unit economics calculations should account for the costs associated with scaling up or down operations during these peak seasons.

Ensuring seamless last-mile operations is the heart of any business's success story; a weak link here could spell havoc in terms of ballooning expenses across the board. Imagine a domino effect spurred on by inefficient supply-chain management or suboptimal space utilization, culminating in prolonged delivery times and soaring fuel costs. This whirlwind of escalating expenses, if not tamed efficiently, could ultimately translate into prohibitive pricing for the end consumer, challenging the sustainability of the business.

But here comes the knight in shining armor: A Customer Experience and Dispatch Management Platform (DMP). This game-changer steps into the arena to tackle these bottlenecks head-on, revolutionizing the way businesses operate. It promises not just to keep costs in check, but also to sculpt an unrivaled customer experience. So, no more grappling with logistics nightmares; with DMP, businesses are geared to deliver their best, ensuring that the last-mile of delivery becomes a smooth and delightful journey for every customer.

Locus' solutions for the CEP industry are designed to revolutionize last-mile operations. From dynamic routing that optimizes delivery routes in real-time to predictive analytics that provide insights for better decision-making, Locus empowers businesses to thrive in a competitive landscape.

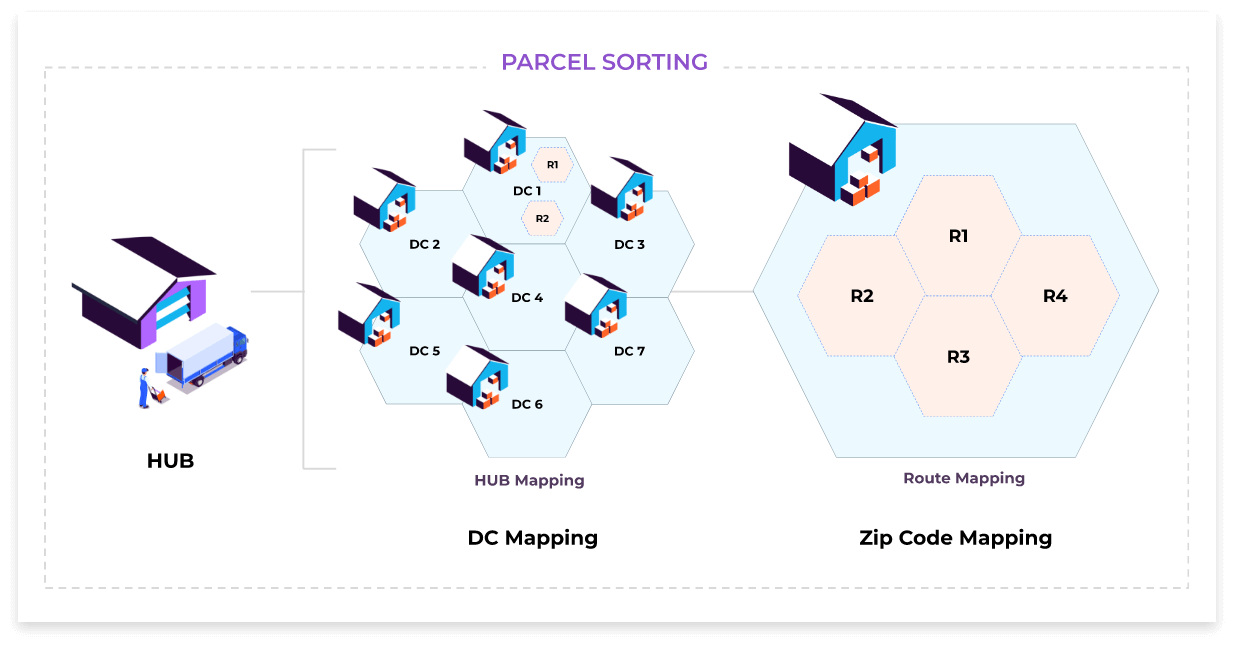

Considering the volumes of packages that parcel and courier companies have to deal with on a daily basis, efficiency in sorting and assignment of shipments to drivers at the last-mile warehouse becomes essential. Locus’ Parcel Sorting Module, integrated with geocoder, leads to fewer mis-routes, less ‘Time under the roof, better unit economics and driver capacity management, as well as a higher asset and real estate utilization.

Hub service areas are divided into multiple zones based on coverage area and density. Each zone also has multiple drivers mapped to it. Locus’ zone-based routing ensures that shipments are divided between drivers in each zone equally, leading to quicker sorting, decreased driver attrition, improved efficiency and driver happiness.

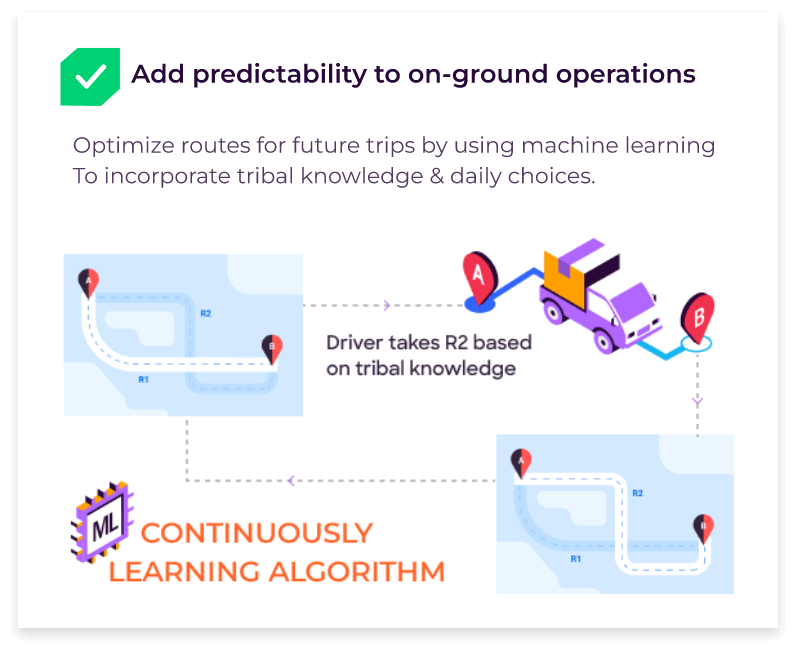

Leverage our proprietary routing algorithms to navigate complex delivery challenges with ease. Simplify daily routing complexities while fostering driver trust through automatic integration of fairness, service hours, and pre-negotiated terms into route planning. Enhance on-ground operations predictability by optimizing future trip routes with machine learning, drawing from tribal knowledge and daily decisions.

By monitoring driver expenses and integrating this data with route planning systems, businesses can identify cost-saving opportunities and optimize resource allocation. This approach enables businesses to improve profitability, make informed decisions, and enhance overall operational efficiency in their fleet management.

CEP businesses need to frequently identify and rectify bottlenecks in the fulfillment process. Locus provides actionable insights that help identify most of the problems in the client process well in advance, acting as the single source of truth for order insights. As a result, there’s data-driven visibility, better control over operations, fewer errors, less effort and risk mitigation.

With a remarkable track record of 650 million deliveries, the Locus Platform has been instrumental in enabling brands from various industries to tap into the full potential of their last-mile logistics. By facilitating increased order fulfillment and sustainable scalability with fewer vehicles, we have played a pivotal role in driving the success of several businesses. One such example is that of Shyft.

Shyft was first launched in the United Arab Emirates as a luggage delivery and airline check-in experiment in 2020, and evolved into a modern logistics company that primarily caters to e-commerce businesses. Shyft has served over 1250+ business customers through its business portal in the UAE, with plans to expand across the Gulf Cooperation Council (GCC). This is how Locus worked with Shyft to bring about 7x growth in 12 months:

Growth in successful

deliveries in 12 months

On-time

deliveries

Increase in

fulfillment rate

Unlocking unit economics in last-mile delivery can unearth hidden operational inefficiencies, serving as a pathway for tactical adjustments and informed strategic planning. This evaluation process is more than a mathematical drill; it’s a beacon guiding vital decisions around pricing, routing, and logistics, and even the potential of fresh business models.

Challenges in last-mile delivery are not roadblocks but unique opportunities for companies to strengthen unit economics. This can be achieved by optimizing processes, cutting costs, enhancing product demand, and fostering varied revenue streams.

Incorporating solutions such as Locus' last-mile logistics can significantly streamline this journey. It’s an innovative tool that not only simplifies route planning and execution but also aids in creating efficient delivery networks, contributing to overall profitability.

By keeping a keen eye on continuous optimization and utilizing state-of-the-art solutions like Locus, businesses can effectively deliver value in the last-mile, meet evolving customer expectations, and maintain their edge in an intensively competitive market. This strategy keeps you not just in the race, but often, comfortably ahead of it.

In traditional brick-and-mortar retail, transportation is usually a smaller part of the cost structure, related mostly to supply chain logistics from suppliers to stores. For e-commerce retailers, however, transportation costs can be substantial, much like in the 3PL/CEP industry. Here, direct-to-consumer shipping costs and returns processing become significant factors.

In physical retail, storage costs relate to both warehousing and the physical retail location itself. For e-commerce, warehousing costs are more significant. Retailers must balance the need to have sufficient inventory on hand (to prevent stock-outs) with the cost of holding and managing that inventory.

Labor costs in the retail industry can be quite varied. In brick-and-mortar retail, there are costs associated with sales associates, cashiers, and in-store managers. In e-commerce, labor costs can revolve around the management of online systems, customer service, and warehouse operations.

In traditional brick-and-mortar retail, transportation is usually a smaller part of the cost structure, related mostly to supply chain logistics from suppliers to stores. For e-commerce retailers, however, transportation costs can be substantial, much like in the 3PL/CEP industry. Here, direct-to-consumer shipping costs and returns processing become significant factors.

In physical retail, storage costs relate to both warehousing and the physical retail location itself. For e-commerce, warehousing costs are more significant. Retailers must balance the need to have sufficient inventory on hand (to prevent stock-outs) with the cost of holding and managing that inventory.

Labor costs in the retail industry can be quite varied. In brick-and-mortar retail, there are costs associated with sales associates, cashiers, and in-store managers. In e-commerce, labor costs can revolve around the management of online systems, customer service, and warehouse operations.

By closely examining the financial dynamics of the retail industry, we identify the key factors that affect its operations and economic performance. By understanding these factors, industry players can make informed decisions to drive growth and success in this competitive sector.

In the retail industry, different products have varying profit margins. When calculating unit economics for last-mile delivery, it's important to consider the specific product mix and their corresponding margins. Some products may have higher margins, allowing for more flexibility in absorbing delivery costs, while others may have lower margins, requiring careful evaluation of delivery expenses to ensure profitability.

Retail businesses often focus on increasing the basket size or average order value of customers. By encouraging customers to purchase more items per order, the delivery costs can be distributed over a larger revenue base, improving unit economics. Analyzing the relationship between basket size, delivery costs, and revenue becomes crucial in calculating the profitability of each order.

The retail industry experiences a higher rate of returns compared to other sectors. Returns can significantly impact unit economics, as they incur additional costs for processing, restocking, and potential re-delivery. When calculating unit economics, it's essential to account for the potential impact of returns and associated costs, as well as the effect on customer satisfaction and retention.

Retail businesses often experience seasonal peaks in demand, such as during holidays or promotional periods. These periods can significantly impact unit economics as they may require additional resources, such as increased staff, temporary storage, or enhanced delivery capacity. Understanding and incorporating these fluctuations into the unit economics calculation is crucial to ensure accurate profitability analysis.

In the retail industry, customer loyalty and repeat purchases play a vital role. Repeat customers tend to have lower acquisition costs and higher LTV. Therefore, when calculating unit economics, it's important to consider the impact of customer retention, loyalty programs, and the potential for upselling or cross-selling to existing customers.

Ensuring seamless last-mile operations is the heart of any business's success story; a weak link here could spell havoc in terms of ballooning expenses across the board. Imagine a domino effect spurred on by inefficient supply-chain management or suboptimal space utilization, culminating in prolonged delivery times and soaring fuel costs. This whirlwind of escalating expenses, if not tamed efficiently, could ultimately translate into prohibitive pricing for the end consumer, challenging the sustainability of the business.

But here comes the knight in shining armor: A Dispatch Management Platform (DMP). This game-changer steps into the arena to tackle these bottlenecks head-on, revolutionizing the way businesses operate. It promises not just to keep costs in check, but also to sculpt an unrivaled customer experience. So, no more grappling with logistics nightmares; with DMP, businesses are geared to deliver their best, ensuring that the last-mile of delivery becomes a smooth and delightful journey for every customer.

Locus helps you to work with thousands of contracted transporters while leveraging centralized order capture and routing. It helps you de-risk your distribution network by delivering through outsourced, contracted, and captive fleets. Businesses can also add or shed capacity based on demand levels to maintain profitable unit economics.

Beat the competition with the fastest turnaround on consignments of all sizes. Implement next day, same day, and on demand fulfillment on a single stack.

With centralized order management, leverage a common fleet to conduct pickups and drop offs in the same routes. Reduce the cost of returns and offer a stress-free experience for buyers.

Ensure compliance with labor regulations with integrated shifts and roster management. Route drivers with task and time on road fairness while capturing and reducing emission footprints. Avail credits and incentives for emission reporting and reduction.

Identify inconsistencies in workforce performance and incentivize better workforce productivity with actionable insights. Asses profitability for each route to allocate more well-suited capacity.

Locus’ new module, Delivery Linked Checkout, improves customer retention, increase average ticket size, strengthens brand equity, improves your standing during consignment negotiations and offer buyers online ordering options complete with accurate real-time SLAs

Leverage a centralized order-to-delivery platform to minimize delivery errors, mis-routes, for a sustainable profitable distribution network. Minimize the need for human oversight and intervention to run a leaner team. Monetize faster delivery options by offering premium/speedy fulfillment services to high value customers.

Automate everything from cancellations, returns, re-scheduled orders, and re-attempts on a single platform with pre-determined intelligent workflows. Automated workflows eliminate delays caused by manual verification and order creations, resulting in quick, seamless, and capital-efficient resolution for all stakeholders

Depending on the demand levels at each zip code, dynamically allocate optimal capacity to each zone daily, resulting in a continuously optimized capacity utilization and fuel savings.

With a remarkable track record of 650 million deliveries, the Locus Platform has been instrumental in enabling brands from various industries to tap into the full potential of their last-mile logistics. By facilitating increased order fulfillment and sustainable scalability with fewer vehicles, we have played a pivotal role in driving the success of several businesses. One such example is that of the digital transformation we made possible in B2B distribution For Unilever.

Vehicle & distance

Savings

of planning times

Saved daily

Increase in

delivery visibility

Unlocking unit economics in last-mile delivery can unearth hidden operational inefficiencies, serving as a pathway for tactical adjustments and informed strategic planning. This evaluation process is more than a mathematical drill; it’s a beacon guiding vital decisions around pricing, routing, and logistics, and even the potential of fresh business models.

Challenges in last-mile delivery are not roadblocks but unique opportunities for companies to strengthen unit economics. This can be achieved by optimizing processes, cutting costs, enhancing product demand, and fostering varied revenue streams.

Incorporating solutions such as Locus' last-mile logistics can significantly streamline this journey. It’s an innovative tool that not only simplifies route planning and execution but also aids in creating efficient delivery networks, contributing to overall profitability.

By keeping a keen eye on continuous optimization and utilizing state-of-the-art solutions like Locus, businesses can effectively deliver value in the last-mile, meet evolving customer expectations, and maintain their edge in an intensively competitive market. This strategy keeps you not just in the race, but often, comfortably ahead of it.

Mrinalini is an editor and writer at Locus. She reads whatever she can get her hands on and, more often than not, it happens to be Harry Potter.

How can Locus help manage your logistics?

Join Industry Leaders: